UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) of the Securities Exchange Act of

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| |||

Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

VERTEX PHARMACEUTICALS INCORPORATED

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table | |

| A Letter from our Executive Chairman and Chief Executive Officer |

Dear Shareholders:

2023 was a transformative year for Vertex. We extended our leadership in cystic fibrosis (“CF”), expanded into new disease areas with CASGEVY regulatory approvals and commercial launches for severe sickle cell disease (“SCD”) and transfusion-dependent beta thalassemia (“TDT”) in multiple regions, and continued the rapid advancement of tremendous successour broad pipeline, which offers the potential for multiple commercial launch opportunities in disease areas outside of CF over the next few years. We believe that these important advances in 2023, combined with our continued excellent financial performance, fuel a new era of medical and commercial diversification for Vertex and more importantly,significant value creation for patients and shareholders alike.

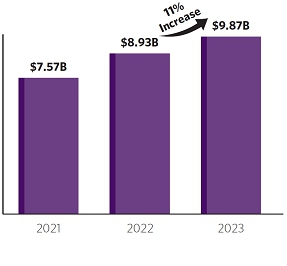

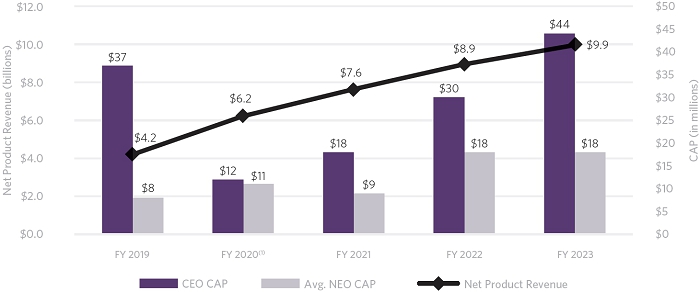

Net product revenues from our CF medicines grew to $9.87 billion in 2023, representing an 11% increase from 2022. We continued to invest significantly in innovation — both internal and external — to support our differentiated research and development (“R&D”) approach, focused on validated targets that address causal human biology, biomarkers that translate from bench to bedside, efficient development and regulatory pathways, and product candidates with transformative potential. Our differentiated R&D strategy has continued to deliver. We have obtained approvals for the thousands of people acrossfirst CRISPR/Cas9 gene-edited cell therapy in the world for the treatment of SCD and TDT and we have also delivered positive Phase 3 results for VX-548, our novel NaV1.8 pain signal inhibitor in acute pain, and for our triple combination of vanzacaftor/tezacaftor/deutivacaftor in CF. Our programs in neuropathic pain, APOL1-mediated kidney disease, and type 1 diabetes have all passed the proof-of-concept stage and represent additional multi-billion-dollar market potential. In total, our clinical-stage pipeline now spans 10 disease areas and multiple modalities, including small molecules, oligonucleotides, and cell and genetic therapies.

Along with cystic fibrosis (CF). Our dream has beendeveloping and commercializing transformative medicines for people with serious diseases, we continue to create a company that has the scientific wherewithalsupport patients, our local communities, and our employees. Last year, Vertex celebrated its 15th Global Day of Service, with participation by 60% of employees contributing nearly 8,300 hours of volunteer work across more than 125 projects with 73 non-profit groups. In addition, Vertex and the financial strengthVertex Foundation provided more than $42 million in charitable donations, with a focus on education, innovation, health, and our local communities. We remain committed to consistently discoverrecruiting, retaining, and developdeveloping highly talented employees from a diverse range of backgrounds, promoting our employees’ continued well-being and professional development, and nurturing our unique culture, which has enabled us to deliver multiple transformative medicines to patients. Our efforts continue to be recognized externally, and in 2023, Vertex was named to Fortune 100 Best Companies to Work For® 2023, Forbes Best Employers for Diversity 2023, and 2023 PEOPLE® Companies that can treatCare.

In summary, consistent execution of our R&D and corporate strategy continues to deliver strong and durable financial results, setting up significant and sustainable long-term growth for the underlying cause of serious diseases, like CF.business. We are making that dream a reality one patient at a time.

| |

Sincerely,

Jeffrey M. Leiden, M.D., Ph.D. | |

Executive Chairman |  Reshma Kewalramani, M.D. Chief Executive Officer and President |

Wednesday, May 15, 2024

9:00 a.m. (Eastern Time)

https://meetnow.global/MQ4XFU9

Dear Shareholders:

You are invited to attend the Vertex Pharmaceuticals Incorporated’s 2016Incorporated 2024 Annual Meeting of Shareholders. At the annual meeting, shareholders will vote:

| to elect the eleven director nominees that are set forth in the attached proxy statement to our board of directors to serve for a one-year term until the 2025 annual meeting of shareholders and until such person’s successor has been duly elected and qualified; |

| to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2024; |

| to hold an advisory vote on our 2023 named executive officer compensation; and |

| on two proposals submitted by our shareholders, if properly presented at the meeting. |

Shareholders also will transact any other business that may properly come before the annual meeting or any adjournment or postponement of the annual meeting.

MEETING INFORMATION

PROXY MATERIALS:

We are using the “Notice and Access” method of providing proxy materials to you planvia the Internet. We are mailing to attend the annual meeting, please ensure that your shares are represented by voting, signing, dating and returning your proxy in the enclosed envelope, which requires no postage if mailed in the United States.

| |

MEETING ACCESS:

THE ANNUAL MEETING WILL BE HELD VIRTUALLY VIA WEBCAST. A VIRTUAL ANNUAL MEETING WILL FACILITATE SHAREHOLDER ATTENDANCE AND PARTICIPATION BY ENABLING SHAREHOLDERS TO PARTICIPATE FROM ANY LOCATION AND AT NO COST. YOU WILL BE ABLE TO PARTICIPATE IN THE MEETING ONLINE, VOTE YOUR SHARES ELECTRONICALLY, AND SUBMIT YOUR QUESTIONS DURING THE MEETING BY VISITING HTTPS://MEETNOW.GLOBAL/MQ4XFU9. THERE IS NO PHYSICAL LOCATION FOR THE ANNUAL MEETING.

Shareholders will need their unique control number, which appears on the Notice of Internet Availability of Proxy Materials or proxy card (printed in the shaded bar), or within the body of the email sending the proxy statement. If you hold shares beneficially through a bank, broker or other nominee (that is, in “street name”), you must register in advance to gain access to the virtual meeting and to beneficial holders of our common stock at

To assistregister, you in reviewingwill need to obtain a legal proxy from your bank, broker or other nominee. Once you have received a legal proxy from them, you must submit a copy of this year's proposals, we calllegal proxy, along with your attentionname and email address to Computershare at legalproxy@computershare.com. Alternatively, you may mail your legal proxy to the following address: Computershare, Vertex Pharmaceuticals Incorporated Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001. Requests for registration must be labeled as “Legal Proxy” and received no later than 5:00 p.m. (Eastern Time) on May 10, 2024. You will receive an email from Computershare confirming your registration and providing your control number. You will need your control number to access the virtual annual meeting, submit your questions and vote your shares electronically.

The annual meeting will begin promptly at 9:00 a.m. (Eastern Time) on May 15, 2024.

We will make a list of our shareholders of record available electronically during the annual meeting. A shareholder wishing access to the list during the annual meeting should contact our corporate secretary in advance of the meeting.

RECORD DATE:

Only Vertex shareholders of record at the close of business on March 18, 2024 are entitled to receive notice of, and vote at, the annual meeting, and, subject to applicable law, any adjournment or postponement thereof.

VOTING:

Your vote matters. Whether or not you plan to attend the annual meeting, we urge you to vote as promptly as possible by Internet, telephone or signing, dating and returning a printed proxy summary. card. If you attend the annual meeting, you may vote your shares during the annual meeting even if you previously voted your proxy. Please vote as soon as possible to ensure that your shares will be represented and counted at the annual meeting.

April 4, 2024

By Order of the Board of Directors,

Joy Liu

Corporate Secretary

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS. This is only a summary; please review thisnotice, our proxy statement, and our Annual Report on Form 10-K for the year ended December 31, 2015,2023 are first being made available to holders of record of our common stock on or 2015 Annual Report, in full.

2023 was a transformational year for the company marked by significant advances in research, development, and commercialization, across the entire company. Our strategy of investing in scientific innovation to developingcreate transformative medicines for people with serious diseases. Overdiseases, with a focus on specialty markets, is delivering. Not only did we extend our leadership in cystic fibrosis (“CF”) by reaching more people with CF than ever before, but we also diversified commercially with the last severallaunch of CASGEVY, our gene-edited cell therapy for the treatment of sickle cell disease (“SCD”) and transfusion-dependent beta thalassemia (“TDT”). In addition, we substantially progressed our broad and diverse pipeline, prepared for additional potential near-term launch opportunities in CF and acute pain, and further strengthened our financial profile.

Today, our CF medicines are collectively being used to treat nearly three-quarters of the approximately 92,000 people with CF in North America, Europe and Australia. Our CF medicines are used by people in over 60 countries, and TRIKAFTA/KAFTRIO is now reimbursed or accessible in more than 40 of those countries. As we look to the future, we expect to continue to grow our CF business through label expansions, approvals of new medicines and expanded reimbursement. We also continue to serially innovate in CF, as demonstrated by our recent announcement of positive data from three pivotal studies evaluating our next-generation triple combination of vanzacaftor/tezacaftor/deutivacaftor (the “vanzacaftor triple”). This new triple combination regimen has demonstrated the potential to provide clinical benefits over and above TRIKAFTA, and also has the advantages of a once-daily dosing regimen and a lower royalty burden. We continue to invest in serial innovation in our CFTR modulator program and have already discovered the next-generation CFTR modulators, with the goal of creating medicines that deliver even more benefit by bringing more people with CF to carrier levels of sweat chloride, which we believe is the pivotal milestone in the journey toward restoring quality and quantity of life for people living with CF. In addition, we are pursuing a nebulized messenger RNA (“mRNA”) therapy, VX-522, designed for the more than 5,000 people with CF who cannot benefit from our CFTR modulators.

In SCD and TDT, CASGEVY is now approved for people 12 years of age and older in the United States (“U.S.”), the European Union (“E.U.”), the United Kingdom (“U.K.”), the Kingdom of Saudi Arabia (“Saudi Arabia”), and the Kingdom of Bahrain (“Bahrain”). We estimate approximately 35,000 people with severe SCD and TDT could be eligible for CASGEVY in the U.S. and Europe, with additional eligible people in Saudi Arabia and Bahrain. Pursuant to our global launch strategy, we have met or exceededbeen educating physicians, patients, caregivers, payors, and policymakers about the significant disease burden of SCD and TDT and the availability of CASGEVY as a potentially curative treatment option. We are also actively engaged with treatment centers, policymakers, and payors to ensure that eligible people have broad access to this transformative therapy. Additionally, we continue to study CASGEVY in younger age groups and work on preclinical assets for myeloablative conditioning agents that would have milder side effects, which could broaden the eligible patient population.

In our goals, building onpain program, earlier this year, we announced positive results from our leadership positionPhase 3 clinical trials evaluating VX-548, a selective, peripherally-acting small molecule inhibitor of the NaV1.8 sodium channel, in the treatment of cystic fibrosis,moderate-to-severe acute pain and our plans to submit for regulatory approval in the U.S. by mid-2024. If approved, VX-548 will be the first of a new class of medicines for acute pain in over 20 years. With an estimated 80 million patients prescribed medicines for moderate-to-severe acute pain in the U.S. every year, representing over 1 billion calendar days of treatment, we believe acute pain represents a multi-billion dollar market opportunity. We also recently announced positive results from the Phase 2 clinical trial evaluating VX-548 in diabetic peripheral neuropathy (“DPN”), a type of peripheral neuropathic pain (“PNP”), and our intention to advance VX-548 into pivotal development for DPN. We also began a Phase 2 clinical trial for patients suffering from lumbosacral radiculopathy, another type of PNP. As with acute pain, our goal is to secure a broad PNP indication for VX-548. There are an estimated 10 million patients prescribed medicines for PNP, yet these medicines have significant limitations, including limited efficacy, significant side effects, and carry the risk of addiction. We believe VX-548 holds potential for a superior overall benefit-risk profile in PNP and, given the large number of people with these conditions we believe that the U.S. PNP market represents another significant, multi-billion dollar opportunity.

In addition to these potential near-term commercial opportunities, we continue to advance our clinical-stage pipeline, which includes programs that have already achieved proof-of-concept, including programs in APOL1-mediated kidney disease (“AMKD”) and type 1 diabetes (“T1D”). In addition, VX-634 and VX-638 are being evaluated in Phase 1 clinical trials in Alpha-1 Antitrypsin Deficiency (“AATD”) and VX-670, a molecule in-licensed from Entrada Therapeutics (“Entrada”), is in Phase 1/2 development for myotonic dystrophy type 1 (“DM1”), an inherited disease affecting approximately 110,000 people in the U.S. and Europe that results in the weakening and destruction of skeletal muscles over time. Recently, we initiated a Phase 1 clinical trial of VX-407, which we are developing for autosomal dominant polycystic kidney disease (“ADPKD”), the most common genetic kidney disease, and representing our tenth disease area in the clinic.

From a financial perspective, our outstanding performance in 2023 resulted in net product revenues of $9.87 billion with strong operating margins and profitability. We are well-positioned to continue to create long-term value for both patients and shareholders with a portfolio of high-value medicines for CF, SCD and TDT, potential near-term commercial launches for products in acute pain and CF, a broad and deep pipeline across ten disease areas, clinical programs with multiple therapeutic modalities that range from small molecules to genetic and cell therapies, and an excellent financial profile.

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 6

Our CF medicines, TRIKAFTA/KAFTRIO, SYMDEKO/SYMKEVI, ORKAMBI, and KALYDECO, are transforming the lives of eligible people around the globe and continue to drive our financial performance.

| Our CF net product revenues increased to $9.87 billion in 2023, an increase of 11% or more than $900 million, from our 2022 CF net product revenues. |

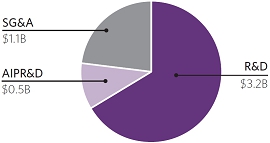

| Our total R&D, acquired in-process research and development (“AIPR&D”) and selling, general and administrative (“SG&A”) expenses increased to $4.8 billion compared to $3.6 billion in 2022. This increase was primarily due to higher AIPR&D, increased investment in support of multiple programs that have advanced to mid- and late-stage clinical development, and the costs to support new launches of Vertex’s therapies globally. |

| INCREASING CF NET PRODUCT REVENUES | TOTAL R&D, AIPR&D AND SG&A EXPENSES |

|  |

2023 R&D, AIPR&D AND

SG&A EXPENSES

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 7

Our differentiated R&D strategy has delivered not only a decade-long leadership position in CF, but also the historic, global approvals for CASGEVY, the first CRISPR-based gene-edited cell therapy to be approved in the world, for people with SCD or TDT.

In CF, advancingour goal is to bring highly effective treatments to all people with CF, and broadening our pipeline, increasing revenues and establishing a strong financial profile. We have two medicineswe began to do just that together arein January 2012 when KALYDECO was first approved to treat a CF population of approximately 25,000 patients1,000 people in the U.S. Since then, we have focused on growing the number of people eligible for our medicines, expanding access to our medicines in additional geographies, and seeking improved treatment options for all people with CF.

Today, our four approved CF medicines are collectively being used to treat nearly three quarters of the approximately 92,000 people with CF in North America, Europe, and Australia. Our CF medicines are used by people in over 60 countries and TRIKAFTA/KAFTRIO is now approved or approximately one thirdaccessible in more than 40 of these countries. In the near term, we expect our CF business to continue to grow as a result of (i) annualization of patients who recently initiated a CFTR modulator, (ii) label expansions, including into younger age groups and additional eligible mutations globally, (iii) expanded reimbursement, and (iv) the launch of the vanzacaftor triple, which will be a therapeutic option for those who have not yet initiated treatment with a CFTR modulator or who have discontinued from a CFTR modulator. In the mid- and longer-term, we foresee growth from (i) increases in the number of people living with CF, population worldwide. These(ii) VX-522, a potential new therapy for the treatment of the more than 5,000 people with CF who cannot benefit from CFTR modulators, and (iii) next-generation CFTR modulator regimens.

In SCD and TDT, 2023 marked the commercial launch of CASGEVY, following approvals in the U.S., U.K., and Bahrain, and with approvals in the E.U. and Saudi Arabia following closely in early 2024. We estimate approximately 35,000 people with severe SCD or TDT could be eligible for CASGEVY in the U.S. and Europe, with additional eligible people in Saudi Arabia and Bahrain. Our global launch strategy for CASGEVY is focused on disease education and awareness for patients, caregivers, health care professionals, payors, and policymakers, as well as engagement with the scientific and medical community regarding CASGEVY clinical data. Our strategy is also focused on activating authorized treatment centers to ensure their readiness to treat patients and achieving access for patients through reimbursement agreements with governments and commercial payors, as well as through early access programs where applicable.

Since the beginning of 2023, notable progress includes:

| The U.S. Food and Drug Administration (“FDA”), the European Commission, the U.K. Medicines and Healthcare products Regulatory Agency (“MHRA”), and Health Canada approved TRIKAFTA/KAFTRIO for the treatment of children with CF 2 to 5 years of age who have at least one F508del mutation in the CFTR gene. |

| The FDA and the European Commission approved the use of ORKAMBI for children with CF from 12 months to less than 24 months of age who are homozygous for the F508del mutation. |

| The FDA approved KALYDECO in children with CF from 1 month to less than 4 months of age. |

| The approval of CASGEVY in the U.S., E.U., U.K., Saudi Arabia, and Bahrain for people 12 years of age and older with SCD or TDT. |

| We have engaged with the Medicaid administrators in all 50 U.S. states, focused on the 25 states with the highest prevalence of SCD patients, and have confirmed pathways to reimbursement in nearly all 25 of these priority states. |

| Approval by the French National Authority for Health of our request for the implementation of an early access program for the use of CASGEVY to treat eligible people with TDT from 12 to 35 years of age. |

| We have begun engagement with payors in the U.K., E.U., Saudi Arabia and Bahrain, including engagement with the National Institute for Health and Care Excellence. |

| Submission for approval of CASGEVY in both SCD and TDT in Switzerland. |

| Activation of 16 authorized treatment centers in the U.S., four authorized treatment centers in Europe, and one in Saudi Arabia. |

| Entry into an agreement with Synergie Medication Collective, a medication contracting organization, covering approximately 100 million people in the U.S., to provide access to CASGEVY. |

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 8

We are preparing for the following potential near-term launches of two new products:

| Vanzacaftor triple in CF. We continued our strategy of serial innovation by completing three pivotal studies evaluating our once-daily triple combination CFTR modulator therapy, vanzacaftor/tezacaftor/deutivacaftor. Results of the clinical trials demonstrate that this triple combination has the potential to provide additional clinical benefits beyond TRIKAFTA for people with CF who have at least one mutation in their CFTR gene responsive to CFTR modulators. This regimen also has the advantages of once-daily dosing and a lower royalty burden compared with TRIKAFTA. We expect to support the launch of the vanzacaftor triple with our existing commercial infrastructure. We expect to submit global regulatory filings for this triple combination by mid-2024, including in the U.S., the E.U., and Canada for people with CF 6 years and older. In the U.S., we will be using one of our priority review vouchers to shorten the regulatory review period from ten months to six months. |

| VX-548 in acute pain. We completed three Phase 3 clinical trials for VX-548, a non-opioid, investigational selective NaV1.8 inhibitor, for the treatment of moderate-to-severe acute pain. Results of the clinical trials indicate that VX-548 could provide a transformative option for patients suffering from acute pain, based on the suboptimal benefit risk profile of existing agents, including the adverse effects and addictive potential of opioids, and the favorable benefit risk profile of VX-548. For our potential near-term commercial opportunity in acute pain, we are focused on the multi-billion dollar market arising from the estimated 80 million patients in the U.S. who are prescribed a medicine for their moderate-to-severe acute pain each year. More than two-thirds of patients receive acute pain prescriptions either during a hospital or ambulatory surgery center visit or at discharge; these prescriptions are concentrated in approximately 2,000 hospitals and 200 integrated delivery networks, which we believe we can reach with a specialty sales force. We plan to submit a New Drug Application (“NDA”) for the treatment of moderate-to-severe acute pain to the FDA by mid-2024. |

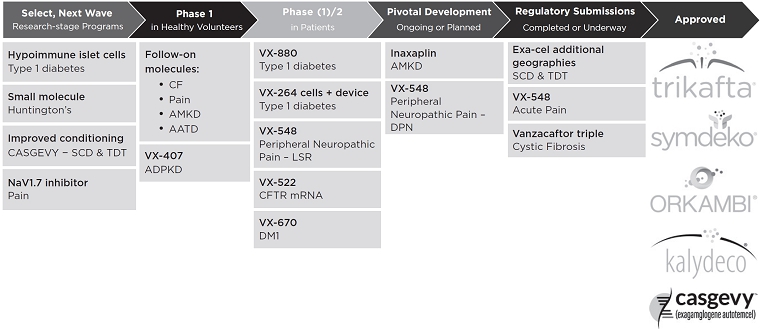

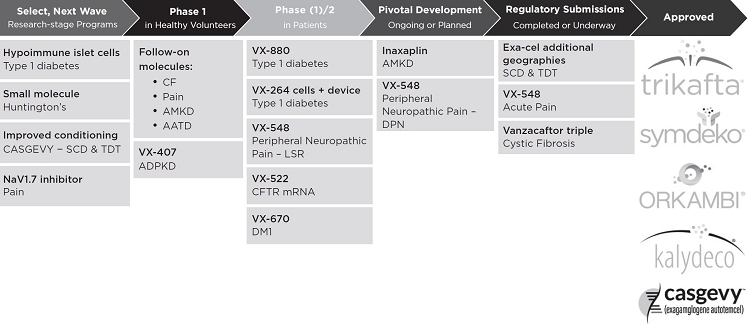

We invest in research and development to discover and develop transformative medicines arefor people with serious diseases, with a focus on specialty markets. Our research and development strategy combines advances in the first,understanding of human disease and only,the science of therapeutics to dramatically advance human health. This strategy was designed to deliver transformative medicines that treatfor serious diseases at high rates of speed and success, and it has delivered just that. Our success in moving novel product candidates into clinical trials, successfully completing pivotal development and obtaining marketing approvals offer multiple proof points of this strategy, and include TRIKAFTA/KAFTRIO, SYMDEKO/SYMKEVI, ORKAMBI, and KALYDECO for CF, and CASGEVY for SCD and TDT. The strategy continues to be borne out by our pipeline, which includes potential future approvals of the underlying causevanzacaftor triple for the treatment of CF and we believe theyVX-548 for the treatment of acute pain. Our approach to drug discovery has also yielded therapies that have fundamentally changeddemonstrated clinical proof-of-concept in additional disease areas, including neuropathic pain with VX-548, AMKD with inaxaplin, and T1D with VX-880, a stem cell-derived islet cell therapy.

Our research and development approach also includes pursuing multiple modalities tailored to the way eligible patients can be treated.specific disease area target under investigation, using biomarkers that translate from the bench to the bedside, and advancing multiple candidates into clinical trials with the goal of bringing first-in-class, followed by best-in-class, therapies to patients. In addition to expanding our small molecule programs, we have a strong CF pipeline, withalso advanced an industry-leading portfolio of programs in cell and genetic therapies.

Our advancements across multiple drug candidates, that may allow us to help all patients with this raredisease areas and life-shortening disease.

| Cystic Fibrosis. We continue to pursue next-in-class, small molecule CFTR modulator therapies and have already identified next-in-class correctors and potentiators, as well as genetic therapies for people with CF who do not make full-length CFTR protein and, as a result, cannot benefit from our current CF medicines. For these more than 5,000 people with CF, in collaboration with Moderna, we are developing VX-522, a CF mRNA therapeutic designed to treat the underlying cause of CF in these people by enabling cells in the lungs to produce functional CFTR protein. We have completed dosing in the single ascending dose portion of the clinical trial for VX-522 in people with CF and initiated the multiple ascending dose portion of the trial. |

|

| eligible patient population. In addition, we are investigating small molecules for the potential treatment of SCD and TDT. | |

|

| moderate-to-severe acute pain in 2024. We also anticipate initiating a Phase 1 study of an intravenous formulation of VX-993 in 2024. | |

|

| this year. We |

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 9

| APOL-1 Mediated Kidney Disease. We completed enrollment in the Phase 2B dose-ranging portion of the clinical trial evaluating inaxaplin for the treatment of AMKD and have selected the dose for and initiated the Phase 3 portion of the Phase 2/3 pivotal clinical trial. |

| Type 1 Diabetes. We completed Parts A and B, and completed enrollment in Part C of the Phase 1/2 clinical trial evaluating VX-880, an allogeneic, stem-cell derived, fully-differentiated, insulin-producing islet cell therapy, used in conjunction with standard immunosuppression, for the treatment of T1D in people with impaired awareness of hypoglycemia and recurrent hypoglycemic events. We have placed the study on a protocol-specified pause, pending review of the totality of the data by the independent data monitoring committee. The clinical trial for our second program in T1D, VX-264, in which the allogeneic stem-cell derived, fully-differentiated, insulin-producing islet cells are encapsulated and implanted in an immunoprotective device to obviate the need for immunosuppression, is a multi-part Phase 1/2 study. We have completed enrollment and dosing in Part A, and Part B of the clinical trial is underway in multiple centers and countries. |

| Myotonic dystrophy type 1. We are exploring multiple approaches to address the underlying causal biology for DM1, including an oligonucleotide linked to a circular peptide, VX-670, which was in-licensed from Entrada. The Investigational New Drug Application (“IND”) for the Phase 1/2 clinical trial of VX-670 in people with DM1 has cleared, as have the regulatory submissions in Canada, the U.K. and multiple other geographies. The study has been initiated in Canada and is expected to initiate in other regions in the near term. |

| Alpha-1 Antitrypsin Deficiency. We continue to enroll and dose Phase 1 clinical trials evaluating VX-634 and VX-668. |

| Autosomal Dominant Polycystic Kidney Disease. We completed pre-clinical enabling studies for VX-407, our first-in-class small molecule corrector that targets the underlying cause of ADPKD in people with a subset of PKD1 genetic variations, in late 2023. The IND for VX-407 in the U.S. has cleared and we have initiated a Phase 1 clinical trial evaluating VX-407 in healthy volunteers in the U.S. |

| In addition to the programs listed above, we have several earlier-stage research programs aimed at diseases that fit our R&D strategy, as well as follow-on programs in diseases already in the clinic. |

We will continue investing in our research and development programs and fostering scientific innovation by identifying additional product candidates through our internal research efforts and investing in business development transactions to access emerging technologies, products and product candidates.

The following chart represents our clinical stage programs and select pre-clinical programs.

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 10

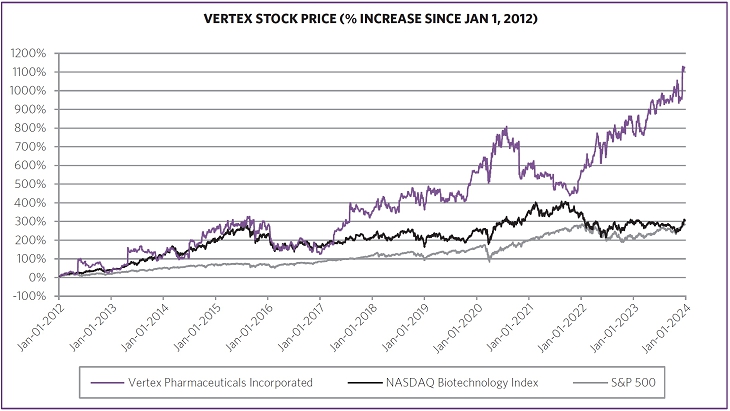

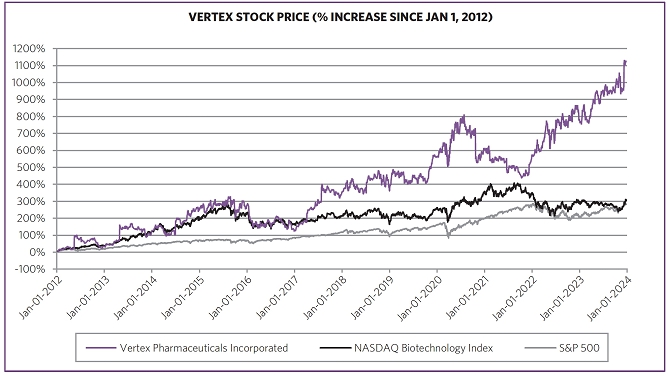

Driven by our financial strengthperformance and became cash flowpipeline successes, our stock price increased 40.9% from $288.78 per share at the end of 2022 to $406.89 per share at the end of 2023. We believe biotechnology companies are best measured over the long term, as opposed to one-year or other shorter-term increments. The following charts show our total shareholder return relative to the Nasdaq Biotechnology Index (“NBI”) and S&P 500 index since the beginning of 2012, when our first CF medicine was approved, as well as our stock price performance over multiple periods. We believe the execution of our differentiated research and development approach and corporate strategy will continue to create shareholder value over the long term.

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 11

We are a leading global biotechnology company that serially innovates to bring transformative medicines to people with serious diseases. We are committed to operating our business responsibly and disclosing our progress to stakeholders on an annual basis. Our progress and efforts with respect to environmental, social, and governance topics, including community engagement and workplace practices, were recognized broadly in 2023. A selection of awards and recognitions include Fortune 100 Best Companies to Work For® 2023, Forbes’ Best Employers for Diversity, PEOPLE® Magazine’s 100 Companies That Care, Points of Light’s Civic 50, Science Magazine’s Top Employers, Seramount’s 100 Best Companies, and many others.

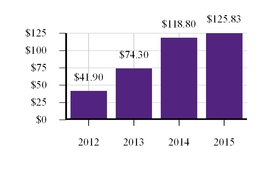

Our corporate responsibility priorities relate to four objectives fundamental to our business: improving the lives of people with serious diseases; fostering a culture of innovation, integrity, and inclusion; carefully managing our operations and environmental footprint; and making a positive impact in the fourth quarter of 2015, allowing us to continue to invest significantly in R&D and return value to shareholders:

| Improve the lives of people with serious diseases | We are focused on discovering, developing and producing innovative medicines so that people with serious diseases can lead better lives. We invest significantly in research and development, with the majority of operating expenses and our workforce dedicated to that purpose. Once we discover transformative medicines, we then work to ensure patients have access to our medicines. We are deeply committed to understanding the challenges and unmet needs of patients and recognize the importance of partnering with, elevating, and empowering patient communities. |

| We are focused on fostering a culture of innovation, integrity and inclusion. Our culture of high ethical standards and integrity is one of the key components to |

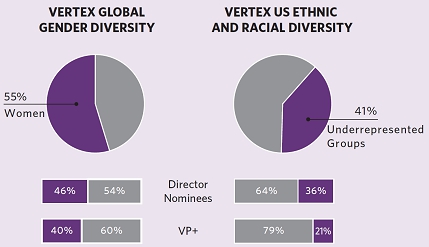

| our work every day. We are committed to building an outstanding, committed and passionate team, and we value inclusion, diversity and equity to foster creativity and innovation. Five of our eleven director nominees, including our chief executive officer (“CEO”), are women, and four of our eleven director nominees are from underrepresented communities. As of December 31, 2023, women represented 55% of our global workforce and 40% of our global leadership (vice president and above). In the U.S., in the year ending December 31, 2023, employees from underrepresented ethnic and racial groups represented approximately 41% of our workforce and 45% of new hires. To promote our employees’ continued well-being and development, we also offer a variety of inclusive benefits and career development opportunities. | ||

| We are committed to limiting our environmental impact and to operating our business in a sustainable manner. In 2023, we established a new target to reduce our Scope 1 and Scope 2 absolute greenhouse gas (“GHG”) emissions. 49% of our global energy comes from renewable energy sources and we source 100% renewable energy for our U.K.-based international headquarters and R&D facility. For our continued efforts, we received a score of an A- on the 2023 CDP Climate Change survey, demonstrating environmental leadership (global average score is C). We also continually improve standards and incorporate industry best practices with | |

| Make a positive impact in | We continue to support communities through collaborations, donations, and |

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement | 3

The following table provides summary information regarding our eleven director nominees. For detailed information about each nominee’s background and areas of expertise, please see Proposal No. 1: Election of Directors.

| Committees | ||||||||||||||

| Name, Occupation or Experience | Age | Director Since | Independent | AC | MDCC | CGNC | S&T | |||||||

Jeffrey Leiden Executive Chairman, Vertex | 68 | 2009 | No | |||||||||||

Reshma Kewalramani CEO and President, Vertex | 51 | 2020 | No | |||||||||||

Sangeeta Bhatia John J. and Dorothy Wilson Professor of Health Sciences & Technology/Electrical Engineering & Computer Science, MIT | 55 | 2015 | Yes |  |  | |||||||||

Lloyd Carney Former CEO, Brocade Communications | 62 | 2019 | Yes |  |  | |||||||||

Alan Garber Interim President and Provost, Harvard University | 68 | 2017 | Yes |  |  | |||||||||

Michel Lagarde Executive Vice President and Chief Operating Officer, Thermo Fisher Scientific Inc | 50 | 2023 | Yes |  | ||||||||||

Diana McKenzie Former Chief Information Officer, Workday | 59 | 2020 | Yes |  |  |  | ||||||||

Bruce Sachs Partner Emeritas, Charles River Ventures | 64 | 1998 | Yes |  |  | |||||||||

Jennifer Schneider Co-Founder and CEO, Homeward Health, Inc. | 49 | Nominee | Yes | |||||||||||

Nancy Thornberry Former CEO, Kallyope, Inc. | 67 | 2023 | Yes |  | ||||||||||

Suketu Upadhyay Executive Vice President and Chief Financial Officer, Zimmer Biomet | 55 | 2022 | Yes |  | ||||||||||

= Chair = Chair | ||||||||||||||

VERTEX PHARMACEUTICALS INCORPORATED- 2024 Proxy Statement 13

In 2023, our executive compensation program and in particular, toreceived substantial support, with approval by approximately 89% of the equity compensation component, which were implemented in early 2016. The new equity compensation reflects fundamental changes in our business and financial profile and feedback we received from our shareholders. While we continually engage in dialoguevotes cast at the annual meeting. We believe this support is consistent with our shareholders, we increased our level of engagement in response to the decline in support for our advisory say-on-pay proposal at our 2015 annual meeting. Over the past year, we held specific discussions regarding executive compensation with shareholders representing approximately 75% of our outstanding stock.

| We maintained the base salary and target equity level for Dr. Reshma Kewalramani, our CEO and President, based on a comparative analysis of companies in our peer group, and maintained her target cash bonus as a percentage of base salary. |

| We maintained target compensation for Mr. Stuart Arbuckle, Dr. David Altshuler, and Mr. Charles Wagner, based on a comparative analysis of companies in our peer group. |

| Dr. Leiden continues to receive no cash compensation for his role as Executive Chairman other than an annual cash payment intended to facilitate participation in the company’s benefit plans, and he will continue to receive equity awards for his fifth year of service as Executive Chairman. |

| Our outstanding performance in 2023 resulted in the board determining that we had achieved a leading rating for 2023 (150 out of a potential 150), with the payment of annual cash bonuses commensurate with this high level of performance. |

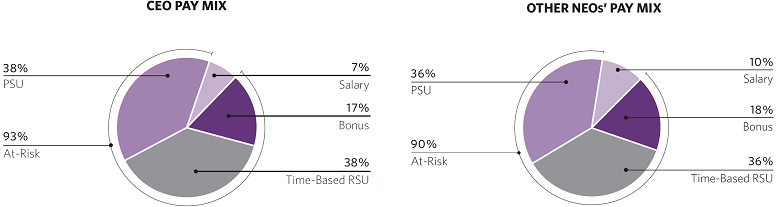

| We maintained the mix of equity granted to our NEOs with 50% of the awards consisting of performance stock units (“PSUs”) that vest upon achievement of specific performance goals and 50% consisting of time-vesting restricted stock units (“RSUs”). This mix rewards stock price appreciation and incentivizes long-term tenure. |

We believe that a proxy access frameworkrobust shareholder outreach program is an important component of maintaining our strong corporate governance practices. We strive for a collaborative approach with shareholders to solicit and understand a variety of perspectives and interests, and our practice has been to engage with our shareholders regularly over the course of the year.

During 2023, we solicited feedback regarding our corporate governance practices from our top 40 shareholders representing approximately 65% of our outstanding shares. Our integrated outreach team included leaders from our Investor Relations, Human Resources, Corporate Responsibility, Corporate Communications, and Legal teams, and we discussed numerous topics of shareholder interest, including our business strategy, R&D approach, diversity initiatives and metrics, employee engagement and development, corporate governance, political and lobbying disclosures, executive compensation, and environmental sustainability matters.

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 14

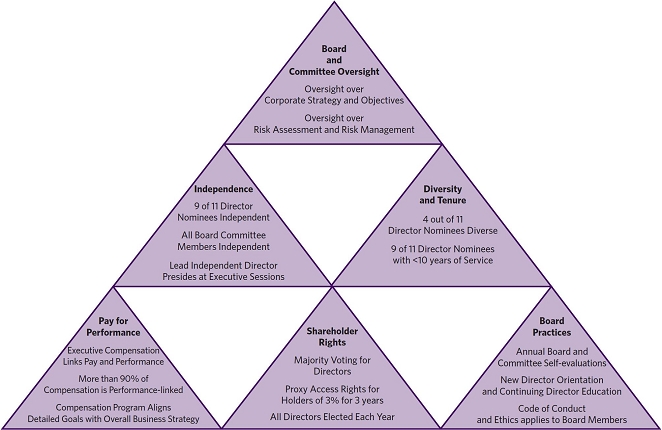

We are committed to maintaining strong corporate governance practices that it believes will provide meaningful access for shareholders while safeguardingpromote the interestlong-term interests of all our shareholders and limiting the potential for abuse.

| Item 1: | FOR |

| Item 2: | FOR |

| Ratify Selection of Independent Auditor for | |

| Item 3: | FOR |

| Approve, on an Advisory Basis, Our Named Executive Officer Compensation | |

| Item | AGAINST |

| Item | AGAINST |

| Shareholder Proposal Regarding |

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 15

Table of Annual Meeting of Shareholders

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement | 5

| Frequently Asked Questions Regarding the Annual | Item 6: Shareholder Proposal #3 | 34 | ||

| Meeting | 7 | Item 7: Shareholder Proposal #4 | 36 | |

| Item 1: Election of Directors | 10 | Compensation Discussion and Analysis | ||

| Board Structure and Composition | 10 | Overview | 38 | |

| Shareholder-Recommended Director Candidates | 11 | Detailed Discussion and Analysis | 46 | |

| Proxy Access By-law | 11 | Management Development and Compensation | ||

| Majority Vote Standard | 12 | Committee Report | 66 | |

| Director Nominees | 13 | Compensation and Equity Tables | 67 | |

| Continuing Directors | 15 | Summary Compensation Table | 67 | |

| Corporate Governance and Risk Management | 18 | Option Exercises and Stock Vested for 2015 | 68 | |

| Independence, Chair and Co-Lead Independent | Total Realized Compensation Table | 69 | ||

| Directors | 18 | Grants of Plan-Based Awards During 2015 | 70 | |

| Board Committees | 18 | Outstanding Equity Awards at Fiscal Year-End | ||

| Risk Management | 19 | for 2015 | 72 | |

| Code of Conduct | 19 | Summary of Termination and Change of Control | ||

| Board Attendance, Committee Meetings and | Benefits | 75 | ||

| Committee Membership | 20 | Employment Contracts and Change of Control | ||

| Audit and Finance Committee | 20 | Arrangements | 76 | |

| Corporate Governance and Nominating | Equity Compensation Plan Information | 85 | ||

| Committee | 20 | Security Ownership of Certain Beneficial | ||

| Management Development and Compensation | Owners and Management | 86 | ||

| Committee | 21 | Section 16(a) Beneficial Ownership Reporting | ||

| Compensation Committee Interlocks and | Compliance | 87 | ||

| Insider Participation | 21 | Other Information | 88 | |

| Science and Technology Committee | 21 | Other Matters | 88 | |

| Director Compensation | 22 | Shareholder Proposals for the 2017 Annual | ||

| Item 2: Ratification of the Appointment of | Meeting and Nominations for Director | 88 | ||

| Independent Registered Public Accounting Firm | 25 | Shareholder Communications to the Board | 88 | |

| Audit and Finance Committee Report | 27 | Householding of Annual Meeting Materials | 88 | |

| Item 3: Advisory Vote to Approve Named | Solicitation | 89 | ||

| Executive Officer Compensation | 28 | Availability of Materials | 89 | |

| Item 4: Shareholder Proposal #1 | 30 | Forward Looking Statements | 89 | |

| Item 5: Shareholder Proposal #2 | 32 | |||

This proxy statement with the enclosed proxy card, is being furnishedmade available to shareholders of Vertex Pharmaceuticals Incorporated in connection with the solicitation by our board of directors of proxies to be voted at our

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement | 6

| Back of Contents |

Our board of directors has nominated Joshua Boger, Terrence C. Kearney, Yuchun Leethe following current directors - Sangeeta Bhatia, Lloyd Carney, Alan Garber, Reshma Kewalramani, Michel Lagarde, Jeffrey Leiden, Diana McKenzie, Bruce Sachs, Nancy Thornberry, and Elaine S. UllianSuketu Upadhyay - as well as Jennifer Schneider, for re-electionelection at our 20162024 annual meeting of shareholders to hold office until our 20192025 annual meeting of shareholders.

Each of the nominees has agreed to be named in this proxy statement and to serve if elected. We believe that all of the nominees will be able and willing to serve if elected. However, if any nominee should become unable for any reason or unwilling to serve for any reason, proxies may be voted for another person nominated as a substitute by our board or our board may reduce the number of directors.

Our board of directors is our company’s ultimate decision-making body, except with respect to those matters reserved to the shareholders. Our board selects our senior management team, which in turn is responsible for the day-to-day operations of our company. Our board acts as an advisor and counselor to senior management and oversees its performance.

The corporate governance and nominating committee (“CGNC”) of our board of directors is responsible for recommending the composition and structure of our board, including identifying, developing, and for developing criteriarecommending qualified candidates for board membership. This committeeThe CGNC regularly reviews director competencies, qualities, skills, and experiences with the goal of ensuring that our board is comprised of an effective teamconsists of directors who function collegially and effectively and who are able to apply their experience toward meaningful contributions to general corporate strategy and oversight of corporate performance, risk management, organizational development, and succession planning.

Our by-laws provide that the size of our board may range between three and eleven members. We currently have nineeleven members on our board. Following our 2016 annual meetingboard and the election of the four directors, we expect that Dr. Boger will resign as a Class III director and will be re-appointed to our board as a Class I Director, with a term expiring in 2017, in order to ensure that the number ofhave eleven members of each class of our board immediately following the 2024 annual meeting of directors remains as nearly equal as possible.shareholders. Our corporate governance and nominating committeeCGNC may seek additional director candidates in the future who meet the criteria below in order to complement the qualifications and experience of our existing board members. Our corporate governance and nominating committeeCGNC may engage a search firm to recommend candidates who satisfy thesuch criteria.

The corporate governance and nominating committeeCGNC seeks to recommend for nomination experienced directors of stature who have a substantive knowledge of our business and industry or who can bring to the board specific and valuable strategic or management capabilities acquired in other industries. The committee expects each of our directors to have proven leadership, sound judgment, the highest ethics and integrity, and a commitment to the success of our company. Wesuccess. It also seekseeks personal qualities that foster a respectful environment in which our directors listen to one another and are engagedengage in robust and constructive.constructive discussions. These goals for our board composition presuppose a diverse range of viewpoints, experiences, and specific expertise. The corporate governance and nominating committeeCGNC considers a nominee’s personal characteristics and business experience relative to those of our existing board members, including the type of prior management experience, levels of expertise relevant to our business, and its growth stage, prior board service, reputation in the business community, personal characteristics such as gender and race, and other factors that the committee believes to be important. At this time,When considering whether or not to re-nominate a director for board service, the CGNC also considers whether the director has served as a member of our board for more than 20 years and whether the director is over 72 years of age. Jennifer Schneider was selected and recommended as a nominee for our board of directors by the CGNC based on the criteria outlined above.

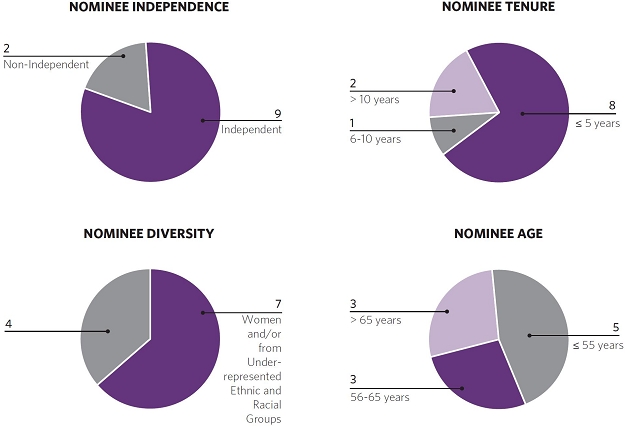

Our commitment to diversity and inclusion is demonstrated by the composition of our board nominees, which includes threefive women and two ethnically diverse individuals.

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 18

The key experience, qualifications, attributesfollowing table and skills broughtcharts provide information regarding our director nominees:

|  |  |  |  |  |  |  |  |  |  | |

| Leadership Experience. We believe that directors who have held significant leadership positions over extended periods of time provide our company with special insights. |  |  |  |  |  |  |  |  |  |  |  |

| Industry Knowledge. We seek directors with substantive knowledge of the healthcare and biotechnology industries to successfully advise and oversee the strategic development and direction of our company. |  |  |  |  |  |  |  |  |  | ||

| Financial Expertise. We believe that an understanding of finance is important for members of our board, and our budgeting processes and financial and strategic transactions require our directors to be financially knowledgeable. |  |  |  |  |  |  |  |  |  |  | |

| International Perspective. We have significant operations outside the United States and value directors with experience in the operation of complex multinational organizations. |  |  |  |  |  |  |  |  | |||

| Public Policy and Regulation. We operate in a highly-regulated industry and seek directors who have experience in public policy and the regulation of medicines. |  |  |  |  | |||||||

| Academic Experience or Technological Background. As a biotechnology company that seeks to develop transformative medicines for patients with serious diseases, we look for directors with backgrounds in academia, science and technology and, in particular, the research and development of pharmaceutical products. |  |  |  |  |  |  |  |  |  | ||

| Commitment to Company Values and Goals. We seek directors who are committed to our company and its values and goals and who value the contributions that can be provided by individuals who believe in our company and its prospects for success. |  |  |  |  |  |  |  |  |  |  |  |

| Independence | Y | Y | Y | N | Y | N | Y | Y | Y | Y | Y |

| Age | 55 | 62 | 68 | 51 | 50 | 68 | 59 | 64 | 49 | 67 | 55 |

| Tenure on Board | 8 | 5 | 6 | 4 | 0* | 14 | 4 | 25 | 0 | 0** | 2 |

| Gender | F | M | M | F | M | M | F | M | F | F | M |

| Underrepresented Ethnic and Racial Groups |  |  |  |  |

| * | Mr. Lagarde was appointed to the Board on October 5, 2023. |

| ** | Ms. Thornberry was appointed to the Board on December 5, 2023. |

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 19

Our commitment to diversity and inclusion is also demonstrated by our directors to our board that are important to our business include:

| Board Diversity Matrix as of April 4, 2024 | ||||||||||

| Total Number of Directors | 11 | |||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||

| Part I: Gender Identity | ||||||||||

| Directors | 4 | 7 | 0 | 0 | ||||||

| Part II: Demographic Background | ||||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||||

| Asian | 2 | 1 | 0 | 0 | ||||||

| Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||

| White | 2 | 5 | 0 | 0 | ||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||

| LGBTQ | 0 | |||||||||

| Did Not Disclose Demographic Background | 0 | |||||||||

The corporate governance and nominating committeeCGNC will consider director candidates recommended by shareholders using the same criteria for director selection described above under

Our by-laws and adoptedprovide for proxy access, a process that allows qualifying shareholders to nominate a director candidate for consideration at an annual meeting of shareholders and have such candidate be included in our proxy materials for the applicable shareholder meeting. This amendment was in response to the approval of a shareholder proposal at our 2015 annual meeting. Our engagement with our shareholders regarding proxy access included discussions over the last several months with a number of our largest shareholders that together hold approximately 46% of our outstanding stock. This engagement allowed us to gain valuable feedback as to the particular proxy access parameters that our shareholders consider appropriate. Based on that feedback and after considering various proxy access provisions recently adopted by other companies, including biotech peers such as Alexion and pharmaceutical companies such as Pfizer, our board of directors adopted a proxy access framework that it believes will provide meaningful access for shareholders while safeguarding the interest of all our shareholders and limiting the potential for abuse. The key elements of our proxy access by-law are as follows:

| Provision | |

| Ownership Threshold and Holding Period | Available to shareholders owning 3% or more of our voting shares continuously for at least 3 years. |

| Number of Board | Total number of proxy access nominees is capped at the greater of 20% of the existing number of board seats (or the closest whole number below 20%) |

| Aggregation Limits | 20-shareholder limit on the number of shareholders who can aggregate their shares to satisfy the 3% ownership requirement. |

| Proxy Fights | Proxy access nominees will not be included in the proxy materials if we receive notice that a shareholder intends to nominate a candidate who is not to be included in our proxy materials. |

| Future Ineligibility | Proxy access nominees who fail to receive at least 10% of the votes cast |

The above table is only a summary of our proxy access by-law and is qualified in its entirety by the actual amendment to our by-laws, which is set forth in Exhibit 3.1 of a Current Report on Form 8-K, that we filed with the SEC on April 27, 2016.by-laws. A shareholder who wishes to nominate a proxy access nominee to be considered for election as a director at the

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 20

| Back of Contents |

Our by-laws provide for a majority votevotes cast standard for uncontested elections of our directors. Under our by-laws, director nominees in an uncontested election who receive more votes cast “for” such director nominee than “withheld” from“against” such director nominee are elected. Our board’s policy is that any nominee for director in an uncontested election who receives a greater number of votes “withheld”“against” than votes “for” the nominee’s election shall promptly tender his or hertheir resignation to the chair of our board following certification of the shareholder vote. Our corporate governance and nominating committeeThe CGNC will promptly consider the tendered resignation. Based on all factors it deems in its discretion to be relevant, the committeeCGNC will recommend that our board either accept or reject the resignation and may recommend that the board adopt measures designed to address any issues perceived to underlie the election results. Our board will then act on the corporate governance and nominating committee’sCGNC’s recommendation. We will promptly disclose our board’s decision, including, if applicable, the reasons for rejecting the tendered resignation. Any director whose resignation is being considered under this policy will not participate in the corporate governance and nominating committeeCGNC or board considerations, recommendations or actions with respect to the tendered resignation.

Other Public Company Boards:  None | Sangeeta Bhatia | ||

Age: 55 Director Since: 2015 | Board Committees:  Chair – Science and Technology Committee  Member – Corporate Governance and Nominating Committee | ||

Experience:  Professor at the Massachusetts Institute of Technology (“MIT”); John J. and Dorothy Wilson Professor of Health Sciences & Technology/Electrical Engineering & Computer Science, since 2005  Co-Founder of Ropirio Therapeutics, a private biotechnology company focused on lymphatic medicine since 2023  Co-Founder of Amplifyer Bio, a private biotechnology company focused on oncology diagnostics, since 2023  Co-Founder of Matrisome Bio, a private biotechnology company, since 2023  Co-Founder of Port Therapeutics, a private company focused on thermal bioswitches in oncology, since 2022  Co-Founder of Satellite Bio, a private company focused on developing satellite organs as living therapeutic solutions, since 2020  Co-Founder of Glympse Bio, a private company focused on developing in vivo sensing technology dedicated to disease monitoring, from 2018 until it was acquired by Sunbird Bio, Inc. in August 2023  Professor of bioengineering and medicine at the University of California at San Diego, from 1998 through 2005  Investigator for the Howard Hughes Medical Institute, a member of the Department of Medicine at Brigham and Women’s Hospital, a member of the Broad Institute and a member of the Koch Institute for Integrative Cancer Research  Holds a Sc.B. in biomedical engineering from Brown University, an S.M. and Ph.D. in Mechanical Engineering from MIT, and an M.D. from Harvard Medical School | |||

Key Skills and Qualifications: Dr. Bhatia is a leading academic scientist and medical researcher. Her extensive experience in the field of biomedical engineering and in-depth understanding on the use of advanced technologies in medical research provide valuable insights to our board of directors, including with respect to our key research and development initiatives. | |||

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 21

Other Public Company Boards:  Visa Inc.  Grid Dynamics Holdings Inc. | Lloyd Carney | ||

Age: 62 Director Since: 2019 | Board Committees:  Chair – Corporate Governance and Nominating Committee  Member – Management Development and Compensation Committee | ||

Experience:  Chief Acquisition Officer of Carney Technology Acquisition Corp. II, a special purpose acquisition corporation, from October 2020 until February 2023  Chief Executive Officer of ChaSerg Technology Acquisition Corp., a technology acquisition company, from September 2018 until March 2020  Chief Executive Officer and Director of Brocade Communications Systems Inc., a global supplier of networking hardware and software, from 2013 until it was acquired by Broadcom in 2017  Chief Executive Officer of Xsigo Systems, a cloud-based infrastructure solutions provider, until it was acquired by Oracle in 2012  Chief Executive Officer and Chairman of Micromuse Inc., a software solutions provider for business and service assurance, from 2003 until it was acquired by IBM in 2006  Previously held senior leadership roles at Juniper Networks, Inc., Nortel Networks Inc., and Bay Networks, Inc.  Member of the board of directors of Nuance Communications Inc., a publicly traded AI-enabled communication company, until it was acquired by Microsoft Corp in March 2022  Ambassador/Special Investment Envoy for Technology Jamaica, since May 2023  Chancellor, University of Technology, Jamaica, a public university in Jamaica, since August 2022  Holds a Bachelor of Science degree in Electrical Engineering Technology from Wentworth Institute of Technology, a Master of Science degree in Applied Business Management from Lesley College, a Honorary Doctorate degree in Engineering from Wentworth Institute of Technology and a Honorary Doctorate degree in Technology from University of Technology Jamaica | |||

Key Skills and Qualifications: Mr. Carney brings strong business judgment, honed through his time as a senior executive and board member of multiple global technology companies, to our board of directors. Mr. Carney has extensive corporate leadership experience, including service as the chief executive officer of several technology companies, as well as financial expertise. | |||

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement | 12

Other Public Company Boards:  Exelixis, Inc. | Alan Garber | ||

Age: 68 Director Since: 2017 | Board Committees:  Member – Audit and Finance Committee  Member – Science and Technology Committee | ||

Experience:  Interim President of Harvard University since January 2024; Provost of Harvard University and the Mallinckrodt Professor of Health Care Policy at Harvard Medical School, a Professor of Economics in the Faculty of Arts and Sciences, Professor of Public Policy in the Harvard Kennedy School of Government, and Professor in the Department of Health Policy and Management in the Harvard T.H. Chan School of Public Health, since 2011  Henry J. Kaiser Jr. Professor, a Professor of Medicine, and a Professor (by courtesy) of Economics, Health Research and Policy, and of Economics in the Graduate School of Business at Stanford University, from 1998 until 2011  Member of the National Academy of Medicine, the American Society of Clinical Investigation, the Association of American Physicians, and the American Academy of Arts and Sciences  Fellow of the American Association for the Advancement of Science, the American College of Physicians, and the Royal College of Physicians  Current Research Associate with the National Bureau of Economic Research and served for nineteen years as founding Director of its Health Care Program  Previously served as a member of the National Advisory Council on Aging at the National Institutes of Health, as a member of the Board of Health Advisers of the Congressional Budget Office, and as Chair of the Medicare Evidence Development and Coverage Advisory Committee at the Centers for Medicare and Medicaid Services  Holds an A.B. summa cum laude, an A.M. and a Ph.D., all in Economics, from Harvard University, and an M.D. with research honors from Stanford University | |||

Key Skills and Qualifications: Dr. Garber brings extensive leadership experience and knowledge regarding science, medicine, and the healthcare industry and in particular healthcare economics to our board of directors. His expertise in health care policy and as an advisor to government agencies provides our board important insights and perspectives on the issues facing our company. | |||

Other Public Company Boards:  Ginkgo Bioworks Holdings, Inc. | Reshma Kewalramani | ||

Age: 51 Director Since: 2020 | Position:  Chief Executive Officer and President | ||

Experience:  Chief Executive Officer and President of Vertex Pharmaceuticals Incorporated since April 2020  Executive Vice President and Chief Medical Officer of Vertex from 2018 through March 2020  Senior Vice President, Late Development of Vertex from 2017 until 2018  Served in roles of increasing responsibility at Amgen Inc. from 2004 to 2017, most recently as Vice President and Head of U.S. Medical Organization  Industry representative to the FDA’s Endocrine and Metabolic Drug Advisory Committee from 2014 through 2019  Holds a B.A. from Boston University and an M.D. from Boston University School of Medicine; Dr. Kewalramani completed her internship and residency in Internal Medicine at the Massachusetts General Hospital and her fellowship in Nephrology at the Massachusetts General Hospital and Brigham and Women’s Hospital combined program  Dr. Kewalramani also completed the General Management Program at Harvard Business School and is an alumna of the school | |||

Key Skills and Qualifications: Dr. Kewalramani possesses strong leadership qualities, significant experience overseeing and scaling the operations of a global enterprise, deep expertise in drug development, and wide-ranging experience in policy matters, demonstrated through her services as a senior executive in the biotechnology sector. She is a physician-executive with extensive industry knowledge garnered through her scientific and medical roles and experience as a global senior leader across multiple disease areas and all stages of drug development. She provides our board of directors with in-depth knowledge of our company gained during her various senior management roles within Vertex and through the day-to-day leadership of our executives as CEO. | |||

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 23

Other Public Company Boards:  None | Michel Lagarde | ||

Age: 50 Director Since: 2023 | Board Committees:  Member – Audit and Finance Committee | ||

Experience:  Executive Vice President and Chief Operating Officer at Thermo Fisher Scientific Inc. (“Thermo Fisher”), a supplier of analytical instruments, life sciences solutions, specialty diagnostics, laboratory, pharmaceutical and biotechnology services, since January 2022; Thermo Fisher is a supplier to Vertex  Executive Vice President at Thermo Fisher from 2019 through 2021  Senior Vice President and President, Pharma Services at Thermo Fisher from 2017 to 2019, joining Thermo Fisher as Senior Vice President, as a result of its acquisition of Patheon N.V., a pharma services company, in 2017  President and Chief Operating Officer of Patheon N.V. from 2016 to 2017  Managing Director of JLL Partners, a private equity firm focused on healthcare, from 2008 to 2016  Holds a bachelor’s degree in business administration from European University in Antwerp and an executive master’s degree in finance and control from the University of Maastricht and University of Amsterdam | |||

Key Skills and Qualifications: Mr. Lagarde has deep experience across numerous segments of the health care industry and markets around the world, as well as a successful track record of growing and scaling profitable businesses. He brings to our board of directors strong leadership experience in biotechnology and pharmaceutical development and commercial manufacturing services as well as financial expertise across several international markets. | |||

Other Public Company Boards:  None | Jeffrey Leiden | ||

Age: 68 Director Since: 2009 | Position:  Executive Chairman | ||

Experience:  Chief Executive Officer and President of Vertex Pharmaceuticals Incorporated from 2012 through March 2020  Chairman of Board of Directors of Vertex since 2012; previously served as lead independent director from 2010 through 2011  Managing Director at Clarus Ventures, a life sciences venture capital firm, from 2006 to 2012  President and Chief Operating Officer of Abbott Laboratories, Pharmaceuticals Products Group and a member of the board of directors of Abbott Laboratories from 2001 to 2006  Held several academic appointments from 1987 to 2000, including the Rawson Professor of Medicine and Pathology and Chief of Cardiology and Director of the Cardiovascular Research Institute at the University of Chicago, the Elkan R. Blout Professor of Biological Sciences at the Harvard School of Public Health, and Professor of Medicine at Harvard Medical School  Elected member of both the American Academy of Arts and Sciences and the Institute of Medicine of the National Academy of Sciences  Member of the board of directors of Quest Diagnostics Incorporated, a publicly traded medical diagnostics company, from 2014 to May 2019; member of the board of directors and non-executive Vice Chairman of Shire plc, a specialty biopharmaceutical company, from 2006 to 2012; Chairman of Revolution Healthcare Acquisition Corp., a special purpose acquisition corporation, from April 2021 to December 2022  Dr. Leiden received his M.D., Ph.D. and B.A. degrees from the University of Chicago | |||

Key Skills and Qualifications: Dr. Leiden possesses strong leadership qualities, demonstrated through his service as a senior executive in the biotechnology and pharmaceutical industries and as a life sciences venture capitalist, and has extensive knowledge of the science underlying drug discovery and development through his experiences as a distinguished physician, scientist, and teacher. As our former CEO and as a former senior executive at Abbott Laboratories, he brings a global perspective to our business and public policy issues facing our company. He also provides our board of directors with in-depth knowledge of our company and our corporate strategy. | |||

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 24

Other Public Company Boards:  MetLife Inc.  agilon health, inc. | Diana McKenzie | ||

Age: 59 Director Since: 2020 | Board Committees:  Member – Corporate Governance and Nominating Committee  Member – Science and Technology Committee  Member – Management Development and Compensation Committee | ||

Experience:  Chief Information Officer of Workday, Inc., a cloud-based financial and human capital management software company, from 2016 until April 2019  Held roles of increasing responsibility at Amgen Inc., a biotechnology company, for 12 years, most recently serving as Senior Vice President and Chief Information Officer  Held various leadership roles at Eli Lilly and Company, a pharmaceutical company, for 17 years, focused on drug development, reducing time to market and improving technology and security standards  Member of the board of directors of Change Healthcare, Inc., a publicly traded healthcare technology company, from August 2019 until it was acquired by United Health Group in October 2022  Holds a Bachelor of Science degree in Computer Information Systems from Purdue University and completed the Information Technology Management Program at University of California, Los Angeles and the CERT Certification for Cybersecurity Oversight from Carnegie Mellon’s Software Engineering Institute | |||

Key Skills and Qualifications: Ms. McKenzie has corporate leadership experience and industry knowledge that make her a valuable contributor to our board of directors. Her service as an executive and innovator in the biotechnology and technology industries and as a member of the board of directors of public companies involved in healthcare issues provide her with multiple perspectives on our industry. Ms. McKenzie brings extensive experience growing, scaling, and transforming global businesses in the healthcare and software industries. | |||

Other Public Company Boards:  None | Bruce Sachs | ||

Age: 64 Director Since: 1998 | Board Committees:  Chair – Management Development and Compensation Committee  Member – Corporate Governance and Nominating Committee | ||

Experience:  Partner Emeritus at Charles River Ventures (“CRV”), a venture capital firm; General Partner at CRV for more than 20 years, including more than 10 years as the Managing Partner  Executive Vice President and General Manager of Ascend Communications, Inc. from 1998 to 1999  President and Chief Executive Officer of Stratus Computer, Inc. from 1997 until it was acquired by Ascend Communications in 1998  Executive Vice President and General Manager of the Internet Telecom Business Group at Bay Networks, Inc. from 1995 to 1997  President and Chief Executive Officer of Xylogics, Inc. from 1993 until it was acquired by Bay Networks in 1995  Holds a B.S.E.E. in electrical engineering from Bucknell University, an M.E.E. in electrical engineering from Cornell University, and an M.B.A. from Northeastern University | |||

Key Skills and Qualifications: Mr. Sachs brings strong business judgment, honed through his experience developing business strategy as a senior executive and in venture capital, to our board of directors. Mr. Sachs has a deep understanding of our business and the global business environment along with expertise in the technology that supports our infrastructure and operations. In addition, Mr. Sachs has extensive business leadership experience, including service as a technology company CEO, as well as financial expertise. | |||

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 25

Other Public Company Boards:  None | Jennifer Schneider | ||

Age: 49 Director Nominee | |||

Experience:  Co-Founder and CEO of Homeward Health, Inc., a company committed to rearchitecting the delivery of health and care in rural America in partnership with communities, since 2022  President of Livongo Health, a biotechnology company, from December 2018 to October 2020, and served as the Chief Medical Officer from September 2015 to December 2018  Served in multiple leadership roles at Castlight Health, Inc., a healthcare navigation company, from 2010 to 2015, most recently as Chief Medical Officer  Member of the board of directors at Revolution Healthcare Acquisition Corp., a special purpose acquisition company, from March 2021 to December 2022  Member of the board of directors at Health Assurance Acquisition Corp., a special purpose acquisition company, from September 2020 until it liquidated in November 2022  Holds a B.S. in Biology from the College of the Holy Cross, an M.D. from Johns Hopkins School of Medicine, and an M.S. in Health Services Research from Stanford University | |||

Key Skills and Qualifications: Dr. Schneider has deep knowledge and expertise in healthcare and technology. She has led or held senior leadership roles in multiple companies focused on delivering innovative solutions in healthcare management. At Livongo, Dr. Schneider led the company through the largest consumer digital health initial public offering in history as well as its merger with Teladoc Health, the industry’s largest ever merger. Dr. Schneider brings extensive experience as a practicing physician and as a leader building healthcare companies that use technology to provide access to clinical services. | |||

Other Public Company Boards:  Denali Therapeutics  Schrödinger Inc. | Nancy Thornberry | ||

Age: 67 Director Since: 2023 | Board Committees:  Member – Science and Technology Committee | ||

Experience:  Founder and Chief Executive Officer of Kallyope, Inc. (“Kallyope”), a private biotechnology company, from November 2015 to October 2021, and served as Chair of Research and Development through December 2023  Self-employed as a consultant to companies in the biotechnology and pharmaceutical industries from August 2013 to October 2015  Served in roles on increasing responsibility at Merck & Co., Inc., a pharmaceutical company, for more than 30 years, most recently as Senior Vice President and Franchise Head, Diabetes and Endocrinology  Holds a B.S. in Chemistry and Biology from Muhlenberg College | |||

Key Skills and Qualifications: Ms. Thornberry has over 30 years of experience in the pharmaceutical and biotechnology industries and her scientific leadership has spanned across drug discovery, research & development, as well as business development. She brings to our board of directors leadership experience in critical scientific roles driving innovation at both public and private companies. Her industry experience, scientific acumen and strategic thinking brings great value to our board of directors. | |||

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 26

Other Public Company Boards:  None | Suketu Upadhyay | ||

Age: 55 Director Since: 2022 | Board Committees:  Chair – Audit and Finance Committee | ||

Experience:  Executive Vice President and Chief Financial Officer of Zimmer Biomet, a leading global innovator and manufacturer of orthopedic solutions, since July 2019  Senior Vice President, Global Financial Operations at Bristol-Myers Squibb from 2016 to June 2019  Executive Vice President and Chief Financial Officer of Endo International from 2013 to 2016  Previously served as interim Chief Financial Officer and Senior Vice President of Finance, Corporate Controller and Principal Accounting Officer of Becton Dickinson and Senior Vice President of Global Financial Planning and Analysis and Vice President and Chief Financial Officer of Becton Dickinson’s international business  Previously held a number of global finance and strategy roles across AstraZeneca and Johnson & Johnson, including Research and Development, Supply Chain, Commercial Operations and Business Development  Spent the early part of his career in public accounting with KPMG, earning his CPA designation and his CMA designation (each designation currently inactive)  Holds a Bachelor of Science in Finance from Albright College and an MBA from The Fuqua School of Business at Duke University | |||

Key Skills and Qualifications: Mr. Upadhyay has extensive experience in the health care industry in financial roles covering all major areas of a fully integrated life sciences business. His service as an executive in the pharmaceutical, hospital supply, and medical device industries provide him with multiple perspectives on our industry. His knowledge and expertise make him a valuable contributor to our board of directors and management. | |||

In each of the director nominee and continuing director biographies, that follow, we highlight the specific experience, qualifications, attributes, and skills that led the board of directors to conclude that the director nominee or continuing director should serve on our board at this time.

For all of the founder of Vertex and has been a director since our inception in 1989. He was our Chief Executive Officer from 1992 through May 2009. He was our Chairman ofabove reasons, our board of directors from 1997 until May 2006 and our President from our inception until December 2000, and from 2005 through February 2009. He was our Chief Scientific Officer from 1989 until May 1992. Prior to founding Vertex in 1989, Dr. Boger heldunanimously recommends that you vote FOR each of the position of Senior Director of Basic Chemistry at Merck Sharp & Dohme Research Laboratories in Rahway, New Jersey, where he headed both the Department of Medicinal Chemistry of Immunology & Inflammation and the Department of Biophysical Chemistry. Dr. Boger holds a B.A. in chemistry and philosophy from Wesleyan University and M.S. and Ph.D. degrees in chemistry from Harvard University.nominees.

VERTEX PHARMACEUTICALS INCORPORATED - 2024 Proxy Statement 27

| Back of Contents | |

We are committed to good corporate governance and integrity in our business dealings. Our governance practices are documented in our Statement of Corporate Governance Principles, which addresses the role and composition of our board of directors and the functioning of the board and its committees. You can find our governance documents, including our Statement of Corporate Governance Principles, charters for each committee of the board, and our Code of Conduct, on our website www.vrtx.com under “Investors—Corporate Governance—Governance Documents.”

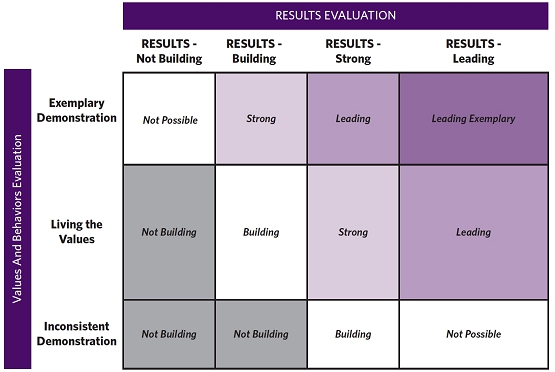

Our board of directors has determined that eightnine of our nine directorseleven director nominees qualify as “independent” under the definition of that term adopted by The Nasdaq Stock Market LLC or Nasdaq. These(“Nasdaq”). In addition, Mr. Kearney, one of our current directors who is not standing for re-election at our 2024 annual meeting of shareholders, was determined to be an independent director. Our independent director nominees are Dr. Bhatia, Mr. Carney, Dr. Boger,Garber, Mr. Kearney, Mr. Lee,Lagarde, Ms. McGlynn,McKenzie, Mr. Sachs, Dr. Schneider, Ms. UllianThornberry, and Mr. Young. Dr. Wayne Riley was an independent director prior to his resignation from our board in June 2015.Upadhyay. Our independent directors generally meet in executive session without management at each regularly scheduled board meeting.